2026 Federal Tax Updates: What You Need to Know

The IRS recently announced the updated federal income tax brackets and other key tax changes for 2026. These annual adjustments are designed to prevent taxpayers from paying higher taxes simply because of inflation. As you prepare for upcoming tax seasons, it’s helpful to understand how these updates may affect your financial situation.

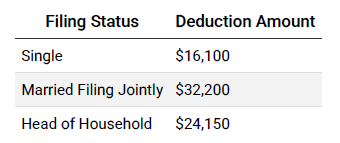

Standard Deduction for 2026

The standard deduction reduces the amount of income subject to tax. Most taxpayers use the standard deduction rather than itemizing.

Standard Deduction Amounts

New deduction for Seniors:

A new deduction is available for some taxpayers beginning in 2025. Effective for 2025 through 2028, individuals who are age 65 and older may claim an additional deduction of $6,000. This new deduction is in addition to the current additional standard deduction for seniors under existing law.

Key Details

- Additional $6,000 deduction for individuals age 65 or older.

- Married couples where both spouses qualify may claim $12,000 total.

- Income phaseout begins at $75,000 for single filers and $150,000 for joint filers.

- Available to itemizers and non‑itemizers.

- Taxpayers must include the qualifying individual’s SSN on the return.

- Married couples must file jointly to claim the deduction.

- To qualify, the taxpayer must turn 65 on or before the last day of the tax year.

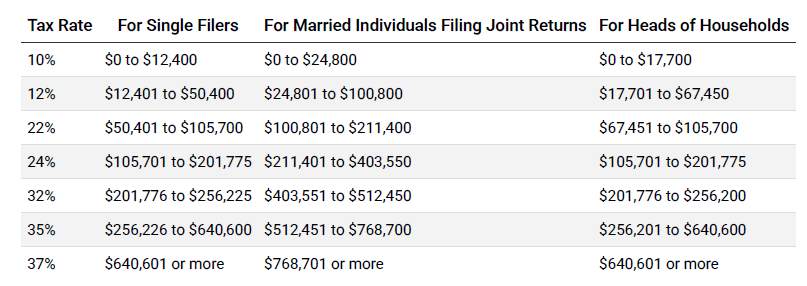

2026 Income Tax Brackets

The IRS has adjusted the tax brackets for inflation. Bracket thresholds rise slightly, meaning more of your income is taxed at lower rates. These changes generally reduce the amount of tax owed on earned income.

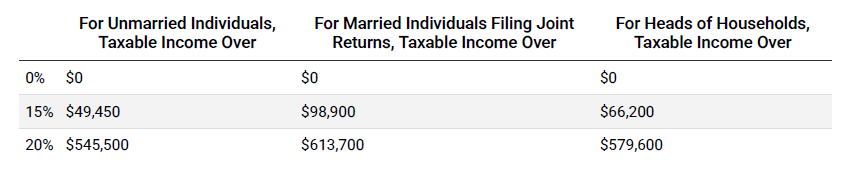

2026 Capital Gains Tax Rates

Long‑term capital gains in 2026 will continue to be taxed at 0%, 15%, or 20%, depending on your taxable income. These income thresholds are adjusted annually for inflation, so the brackets will shift slightly from year to year. It’s important to note that 2026 capital gains rates apply only to assets sold in 2026. If you sell an asset in 2025, it’s taxed under 2025 rules, nothing in the upcoming tax changes alters this timing.

Other Notable IRS Updates

- Gift tax exclusion remains $19,000.

- 401(k), 403(b), 457, and TSP contribution limits increase to $24,500.

- Catch‑up contributions for age 50+ rise to $8,000. Catch‑up contributions become Roth‑only for high‑income earners (those earning $150,000+).

- Enhanced catch‑up for ages 60–63 increases to $11,250 under SECURE Act 2.0.

- SIMPLE plan catch‑up for ages 60–63 increases to $5,250.

- SIMPLE plan annual contribution limit increases to $17,000.

Understanding Your Effective Tax Rate

Because the U.S. uses a progressive tax system:

- Your marginal tax rate is the rate applied to your last dollar of income.

- Your effective tax rate is the average rate you pay across all income levels.

A clear understanding of both helps you make informed financial decisions.

Staying Informed

For full IRS announcements and ongoing updates, visit the IRS website: IRS releases tax inflation adjustments for tax year 2026 | Internal Revenue Service

These adjustments may offer meaningful tax relief for many households. By understanding the changes now, you can better plan for the year ahead and take advantage of available opportunities.

As we look ahead to 2026, we ask all of our clients to forward a copy of their completed tax return to taxes@bandcdfinancial.com. Reviewing your return each year allows us to understand your full financial picture and identify opportunities that might otherwise be missed. We continue to encourage coordination with your CPA or tax advisor on all tax‑related matters, but as your investment manager and wealth advisor, we can only provide the highest level of guidance when we have complete and accurate information.

For those who are not yet clients, this is an important question to consider: Is your current advisor asking for this level of detail? If not, it may be worth exploring why. A truly comprehensive advisor should be looking at more than just your investments — they should be helping you connect every part of your financial life so you can make the most informed decisions possible.

Source: https://taxfoundation.org/data/all/federal/2026-tax-brackets/