B&C Financial Advisors Annuity Series – Part 3: Sample Annuity Contract

In the second part of our series on annuities, we took a look at some pros and cons of annuities. To end the series, in this post, we will walk through an example of an actual annuity contract one of our clients purchased before becoming a client of B&C Financial Advisors.

(We have removed the client’s name to protect their privacy.)

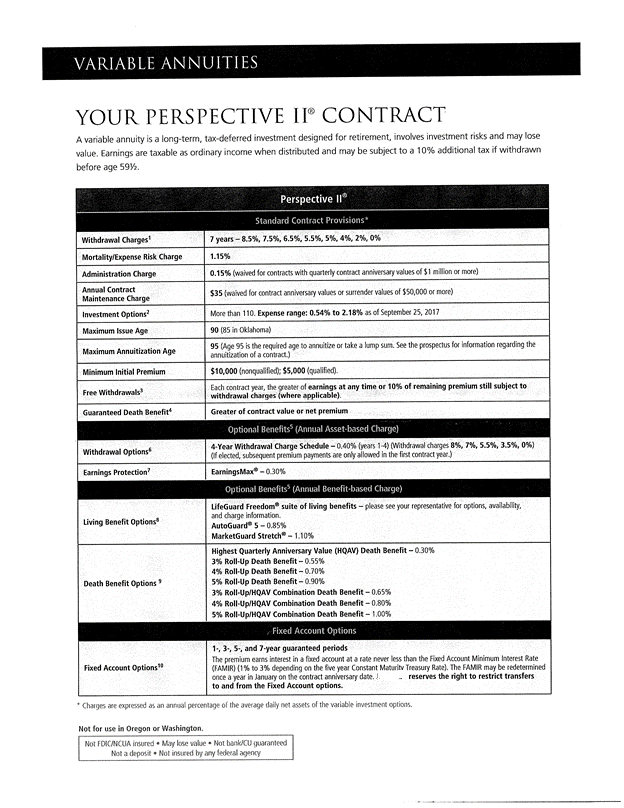

Below is a summary of the contract our client purchased in 2017 from a large, national life insurance company. We will use this summary to highlight some of the features of this annuity.

Type of Annuity

This is a variable annuity, meaning the contract value fluctuates as the underlying investment options increase and decrease in value over time. Normally, the contract’s earnings are tax-deferred, thus the owner would pay ordinary income tax on just the earnings portion if they decide to withdraw any amount from the contract (plus a 10% penalty if withdrawn before age 59 ½). However, the owner of this contract purchased the annuity in their Traditional IRA, so any withdrawal amount would be fully taxable at ordinary income rates. Thus, since assets inside an IRA are already tax-deferred, there is generally no additional tax benefit to purchasing a variable annuity inside an IRA.

Contract Fees

The fees associated with many annuity contracts can add up quickly, and this contract is no exception. First, as with most annuity contracts, there is a surrender charge (called a Withdrawal Charge in our example) for the first seven years of the contract, beginning at 8.5% in the first year and decreasing to 2% in the seventh year. This means if the client decided they no longer wanted the contract during this period and wanted to cash it in, they would have to pay between 2% and 8.5% of the contract value—just to have access to their own money!

Then, there is an annual Mortality/Expense Risk Charge (a charge imposed by the insurance company to compensate them if the annuity owner were to die prematurely, causing them to pay out a death benefit sooner than expected) of 1.15% of the contract value and a 0.15% annual Administration Charge. Therefore, before even accounting for internal mutual fund expenses, this contract has annual expenses of 1.3%. As shown in the summary above, the internal fees of the Investment Options range from 0.54% to 2.18%, meaning the total annual contract fees could range from a minimum of 1.84% to up to 3.48%, depending on which Investment Options are chosen for the underlying subaccounts. This also does not include any additional riders that can be added to the contract, such as the Living Benefit Options or Death Benefit Options shown.

Other Observations

1. Held Inside Traditional IRA: While not shown in the summary above, it is important to note this client held this annuity inside her Traditional IRA. Since the growth in this variable annuity is tax-deferred, and all growth inside any Traditional IRA is tax-deferred already, the client did not realize any additional tax advantage by purchasing the annuity inside her IRA. When describing the insurance company’s annuity sales process, our client stated it was not explained to her that she was not receiving any additional tax benefit by purchasing it in her IRA.

2. Fixed Account Options: Premiums paid into the annuity can be allocated to a fixed account option that earns a rate of interest for 1-, 3-, 5-, or 7-year guaranteed periods. This sounds great, except the rate can be re-determined once per year, and the insurance company can restrict how much can be transferred into and out of these options. Thus, there is much less flexibility when it comes to adjusting the investments if/when there are changes in underlying interest rates.

3. “Not insured by any federal agency”: This statement is found in the tiny box at the bottom of the annuity summary. Typically, when money is deposited into an account at a financial institution, that account is federally insured against the insolvency of the bank or brokerage at which the account is held. For example, the Federal Deposit Insurance Corporation (FDIC) insures bank accounts up to $250,000*, and the Securities Investor Protection Corporation (SIPC) insures investment accounts up to $500,000**. Since this a variable annuity and is not federally insured, a person who purchases this product is protected mainly by the financial strength of the issuing insurance company. Thus, if the insurance company were to go bankrupt, the owner of the contract may have limited ability to recover money invested into the policy. In general, standard life insurance policies are insured by state governments, and insurance companies often purchase what is known as “reinsurance,” but there is often language specifically excluding coverage of non-guaranteed portions of variable annuities. In Florida, for example, the Florida Life & Health Insurance Guaranty Association (FLHIGA) states on its website it excludes “any portion or part of a variable life insurance contract or a variable annuity contract that is not guaranteed by a licensed insurer.”

We hope you have found this series on annuities informative and helpful. If you have any questions regarding an annuity policy you own, please contact our office at 904-273-9850 to speak with one of our advisors or email us at [email protected].

The information presented in this article is for educational purposes only and is not meant to provide individual advice to the reader. There is no guarantee the information provided above relates to your personal situation. All financial situations are unique and should be advised as such.

*Per the FDIC website: “The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per ownership category. Deposits held in different ownership categories are separately insured, up to at least $250,000, even if held at the same bank.”

**Per the SIPC website: “SIPC protects against the loss of cash and securities – such as stocks and bonds – held by a customer at a financially-troubled SIPC-member brokerage firm. The limit of SIPC protection is $500,000, which includes a $250,000 limit for cash.”

Related Tag: Financial Advisors Florida